Frequently Asked Questions

A buy to Let mortgage is where you a buy another property specifically with the intention of letting it out and as long as the rent covers the mortgage payments due by a certain amount the mortgage is agreed based on the rent and not your own income.

Normally a minimum of 25% deposit is needed for a Buy to Let mortgage, however some niche lenders can accept a bit less.

This is a score that we all have and is based on various things about the way we have conducted our finances over the preceding six years and is used by Banks and Financial institutions to assess our credit worthiness and whether they will lend.

You can improve your credit score by proving that you can cope with all your various credit commitments such as loans and credit card payments and by paying things like mobile phone bills and utility bills on time. Being on the electoral roll also helps.

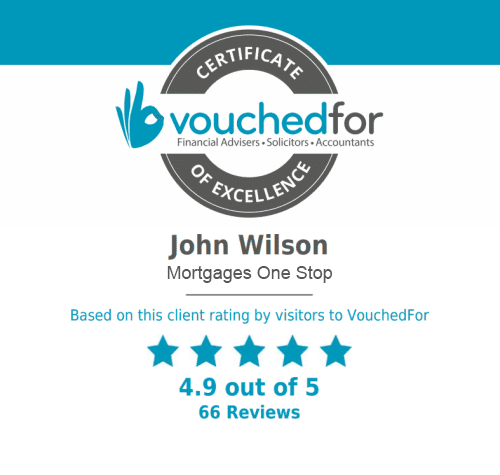

By contacting us at Mortgages One Stop for a free no obligation assessment.

- Solicitor’s fees: which are also based on the purchase price, a quotation can be

provided on request; a typical first time buyer will pay between £500.00 and

£1,000 and possibly a bit more for Home movers. - Valuation fee: which is also based on the purchase price and varies from lender

to lender and are sometimes free to First Time Buyers. In Scotland a Home

report is required but has normally already been done by the seller and the Lender will

require a copy. - Lenders arrangement fees: This can be anything between zero and £999 and if

there is a fee this can sometimes be added to the mortgage. - Mortgage broker fee: For our services in relation to Mortgage contracts, we will

charge a fee from £0 to £999 on completion of the Mortgage. The exact amount

charged will depend upon your circumstances and the complexity of the case,

however this will be fully discussed and agreed with you in our accompanying

fee agreement.

The amount that each person or couple can borrow is based on how much they earn their current credit commitments and to some extent the amount of deposit they have.

The minimum deposit can be as low as 5% although this is not true of every lender the most common deposit would be 10% and there is a significant reduction in the interest rates available once the deposit reaches 15% and higher.

The cost of the mortgage to you is worked out by the amount you actually borrow, the term of the mortgage and the interest rate that is charged and therefore is quite specific to each individual.

A repayment mortgage is guaranteed to pay off your mortgage by the end of the term as long as all payments have been made. With an interest only mortgage your monthly payments only pay the interest that is due so at the end of the term you still owe the same amount that you originally borrowed and would need to either sell your property to repay the mortgage or find the money to repay it from another source by that time

The building itself needs to be insured and life insurance is recommended along with Mortgage Payment Protection Insurance which is designed to pay your mortgage payments if you are either off work due to accident or sickness or lose your job due to redundancy. We can give you Independent whole of market quotes so you are paying a competitive monthly premium.

Yes, we can transact moving mortgages from one company to another if they are offering a more competitive rate.

Yes you can but you have to be aware of early repayment penalties if you have only had your current mortgage product for a short time.

Yes, normally you are allowed to pay off up to 10 percent of the balance in any one year without incurring any repayment penalties.

You can normally only have one residential mortgage but you are able to buy another property to let out.